TMO Talks To Laura Richardson, Claims Assessor

Headquartered in Aylesbury in Buckinghamshire, Warranty Solutions Group (WSG) is the UK’s premier motor warranty provider that’s driven by quality, passion and experience. The company provides some of the most comprehensive warranties for used vehicles on the market today through its nationwide approved dealer network.

Headquartered in Aylesbury in Buckinghamshire, Warranty Solutions Group (WSG) is the UK’s premier motor warranty provider that’s driven by quality, passion and experience. The company provides some of the most comprehensive warranties for used vehicles on the market today through its nationwide approved dealer network.

WSG gained accreditation to The Motor Ombudsman’s Motor Industry Code of Practice for Vehicle Warranty Products at the beginning of 2022. We spoke to Laura to find out more about her role, and how the business goes above and beyond to help customers.

TMO: What are some of your standout career moments and achievements to date?

LR: The biggest highlight of my career so far has definitely been playing a part in WSG winning our first award – just two weeks ago in fact! We won the prestigious Warranty Provider of the Year category at the Motor Trader Independent Dealer Awards. It’s a phenomenal achievement, especially as WSG was only formed 18 months ago. We’re all incredibly proud to have been recognised as the best warranty company in the industry.

WSG is also nominated for other awards which is amazing, including the main Motor Trader Industry Awards in November, for Warranty Provider of the Year and Aftersales Provider of the Year.

TMO: What does your role as a Claims Assessor involve, and what departments do you interact with?

LR: My main responsibility is to assess and authorise warranty claims, which probably sounds simple, but it’s actually quite technical.

Where we’re responding to a customer, the first stage is to record the fault details and signpost them to a suitable garage. In most cases, they’ll have the choice of either using one of our approved garages or their own.

Sometimes a fault will need further diagnosis if it isn’t obvious. Many of our warranties include diagnostics costs, which we settle as part of the claim if the fault is covered. Once we know it’s a valid claim, we provide an authorisation code to the garage so work can begin.

Normally authorisation can be given in just a few minutes over the phone once we have all the information, but it depends on the nature of the problem and the complexities of the repair. Occasionally, repairs will involve other parties – for example if the vehicle has to be recovered by our breakdown partner or we need it to be independently inspected – which can make the claims process a little longer. However, we always aim to take the headache away from the customer by managing the repair process as much as possible. That’s just one of the reasons why WSG is the UK’s only five-star rated warranty company!

My job requires me to constantly interact with other members of the claims team, as well as sales and accounts. A lot of my time is also spent discussing repair details with garages, our dealers and suppliers to make sure each claim runs smoothly, and that we’re delivering the best possible customer outcomes.

TMO: What are the main skills needed to be an effective Claims Assessor?

LR: It takes a specific skillset to be a great Claims Assessor. A comprehensive technical knowledge of modern vehicles is of course the most important attribute, but you also need patience and empathy to really understand the customer’s situation and be able to put them at ease.

Vehicle problems can be extremely stressful, so a big part of our job is to listen carefully and reassure customers that we’ll do our best to sort their issue, especially when we’re dealing with emotionally charged or difficult situations. Quick decision-making and strong problem-solving skills are a must too, as well as excellent communication and a methodical approach.

TMO: What are some of the most common warranty claims that your business receives?

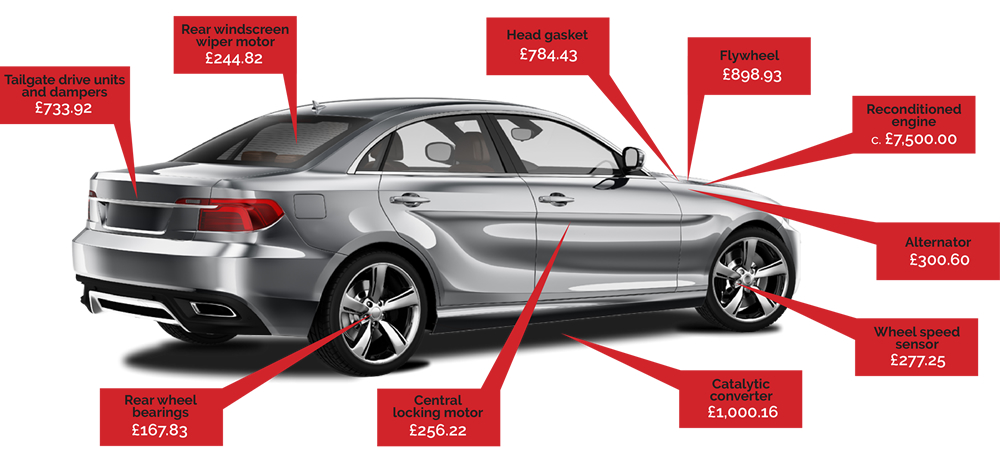

LR: Some of the most reported faults relate to alternators, starter motors, EGR valves, water pumps, engine sensors and batteries, regardless of the type of vehicle.

During summer, we see an influx of claims relating to air conditioning, particularly condensers. Then in winter, it’s normally heating issues, such as heater fan motors and thermostats. We recently paid our biggest claim to date too – £16,848 for an engine replacement on an SUV.

TMO: What key criteria or documentation do you assess claims on?

LR: Once we know the cause of failure, the claim then needs to be verified. Before a repair can be authorised, we check component prices against other parts providers, and labour times against manufacturer repair schedules.

If the vehicle was diagnosed, we’ll request the full report including any fault codes where applicable. We may also ask for photos or a video of the problem, and sometimes proof of service history.

If the vehicle was inspected by an independent assessor, we’ll need their report, including what they believe to be the cause of failure. The information we request really depends on the problem and what’s involved to rectify it.

No two days are the same, as we never know what claims are going to come in!

TMO: What proportion of claims are successful, and for those that are not accepted, what are some of the most common reasons?

LR: Over the last 12 months, 81% of all repairs reported to us became successful claims, which we believe is an industry-high figure. Our warranties cover thousands of parts and faults, including many normally excluded by other providers, so there’s a high likelihood that the problem will be covered.

The 19% rejected were mostly due to the issue either being a serviceable or consumable item – in many cases, brake pads and discs, wheels and tyres, or the customer not following the claims process.

TMO: How many claims do you assess on a weekly basis, and are there some periods of the year that are busier than others?

LR: At the moment, each Assessor authorises around 30 claims per week on average. However, the company is growing at lightning speed, as more dealers continue to join us. Every department is expanding rapidly to support the growth, and it’s only going to get busier.

This year alone, we’ve taken on four new Claims Assessors and a Claims Administrator – with another three Assessors joining between now and Christmas!

TMO: What are the key areas of focus for WSG during the last quarter of this year?

LR: To continue growing our dealer network, building our approved repairer networks and recruiting even more amazing people to the team!

TMO: As a business accredited to TMO’s Vehicle Warranty Product Code, how does WSG go above and beyond?

LR: Having spent 30 years in customer service roles, I can honestly say that WSG’s customer care is second to none. Everything we do is geared around giving drivers a brilliant warranty experience.

One service that our customers really appreciate is the welcome call they receive at the start of their cover. These calls give us the opportunity to make sure they fully understand the product, and to walk them through the claims process and answer any questions.

When it comes to claiming, we can even manage the entire repair process on the customer’s behalf if they don’t want to get involved. We’ll look after everything, from finding a suitable garage and booking the vehicle in, to arranging parts and liaising directly with the garage throughout.

Many of our warranties also include some great extra benefits, such as free breakdown cover, car hire and discounts on windscreen repairs through our partner Autoglass®. It’s all the extra touches that ultimately set us apart.

TMO: What do you enjoy most about working in the motor industry?

LR: There are so many reasons why I love my job and the industry. The most rewarding part though is knowing I’m making a difference to our customers’ lives by giving them a great service, especially when they’re in stressful or desperate situations.

It’s also a constant learning curve with ever-advancing vehicle technology, so we’re always increasing our knowledge. Having the support of such a collaborative team makes all the difference too. I also love being a female in a male-dominated sector, and I hope this interview inspires more ladies to join our fantastic industry!

TMO: What are your main interests and hobbies when you’re not in the office?

LR: I recently bought my first house, so I’m currently in the process of redecorating and organising. It’s a never-ending project that’s taking up most of my spare time!

I’m also a qualified cake creator and make bespoke cakes for friends and family. I have a Level 1 City and Guilds in Creative Skills in Sugar Craft, and achieved a distinction for my chocolate work and a Merit for the rest of my course work!

I love taking my Pug for long walks in the countryside too. He certainly keeps me active.

And one day I’d like to learn to play the saxophone!

TMO: Thank you for your time Laura, and it has been a pleasure talking to you.

Interview conducted in October 2022.

Visit www.warrantysolutionsgroup.co.uk to find out more about Warranty Solutions Group.

Images courtesy of Warranty Solutions Group.