EV disputes brought by consumers to TMO in Q4 2023

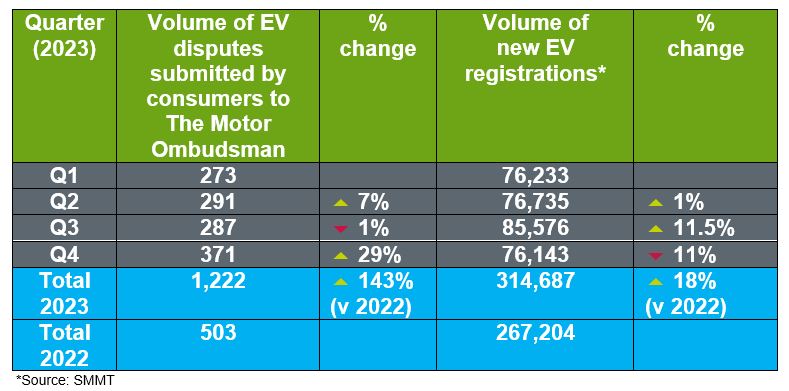

After posting a small decrease in the third quarter of 2023, relative to the previous three months, disputes brought to The Motor Ombudsman by consumers about electric vehicles (EVs) recorded a rise in the final quarter of 2023, reaching a peak of 371. This represented a 29% increase versus the 01st July to 30th September period (287).

However, overall EV complaints recorded during 2023 remain few in number, and represent 0.4% of all new EV registrations in the UK, thereby illustrating a positive purchase and ownership experience for today’s EV adopters.

Broken down by individual categories, issues encountered by consumers during the last quarter of 2023, were as follows:

1. Customer service and purchase issues (29%)

Mirroring the trend seen throughout 2023, customer service issues at the point of purchase, and during ownership, remained the key driver of complaints about EVs during the final quarter of the year, and made up the same proportion of disputes as in Q3 (29%).

Concerns stemmed from factors, such as a lack of transparency about vehicles with existing recalls at the point of sale, remedial recall work taking time to be carried out, administrative and documentation errors, and businesses supplying courtesy cars that were in a sub-standard condition.

On an average monthly basis, for disputes about the purchase of an EV during the last quarter, 51% of complaints stemmed from a new car (versus 57% in Q3), with the remaining 49% originating from acquiring a used vehicle (compared to 39% in Q3). This decrease in the new car percentage can be expected, given that new EV sales amongst consumers struggled towards the tail end of 2023, and used EV values fell, thereby tempting more buyers to the second hand market.

2. Chassis and motor issues (17%)

The proportion of complaints relating to the chassis and motor areas of the vehicle fell by three percentage points to 17% in the 01st October to 31st December period, down from 20% seen during the two preceding quarters. Examples of vehicle parts in this category that led to customer dissatisfaction, included the suspension, tyres, and brakes, with failures, faults and defects all in the spotlight during Q4.

3. Electrical and software issues (16%)

In contrast, problems resulting from electrical systems and software were up very slightly from quarter to quarter, from 15% to 16%, after sitting at 14% in Q2. With EVs so heavily reliant on electrical systems, these can cause more pronounced operational problems with vehicles when problems occur. During the fourth quarter, vehicle owners experienced issues, such as handbrakes automatically applying whilst vehicles are in motion, faults with brake feel simulator units, faulty radar sensors, and headlights causing interior cabin lights to go off in error.

4. Interior and cabin systems issues (11%)

Interior and cabin systems saw a one percentage point rise in the fourth quarter, (up from 10% in Q3, and 8% in Q2), as a greater number of issues plagued consumers during the final three months of 2023. Problems encountered by EV owners with internal fixtures, were namely, interior screens going blank, rattling from gloveboxes, torn stitching in seats of excellent condition, and incorrect steering wheels being fitted on new cars. There were also faults with cabin systems, which encompassed recurring climate control deficiencies, and air conditioning failures.

5. Exterior issues (8%)

Concerns encountered with the vehicle exterior recorded another positive one percentage point drop to 8% of overall issues in Q4, down from 9% in Q3, and 10% in Q2. Problems highlighted by consumers with this aspect of the vehicle, originated from the bodywork, where the paint and finish were found to be defective, door handles rattling and failing, and elements of the agreed specification being removed following new car orders.

6. Charging issues (8%)

Disputes in relation to an EV’s on-board charging system became greater in number in the fourth quarter, after also climbing as a proportion of EV disputes from 5% in Q2, to 6% in Q3. Faults that were reported as part of the submissions by consumers to The Motor Ombudsman, took in the likes of vehicles being unable to achieve advertised charging speeds, melting pins in charging ports, and only being able to replenish battery cells with the ignition on.

7. Battery issues (6%)

Battery issues fell overall by four percentage points from 10% in Q3 back to 6% – the same level as in Q2, which may suggest that owners may have encountered a greater level of reliability with this key EV component in Q4. Traction battery faults were a common occurrence in this category, with battery management system malfunctions, and faults after two weeks of new car ownership, all being reported within case submissions.

8. Range issues (5%)

Range concerns, which principally result from consumers not achieving the advertised distance for a full charge, drove the fewest number of disputes once again during the last quarter of 2023, mirroring what was witnessed in Q3, although complaints were up in this area (from 1% to 5%).

After the latter months of the year being relatively mild, range concerns stayed low overall, but these may start to spike again in 2024 if the UK experiences icy conditions and sub-zero readings during the first quarter, as the winter gives way to spring.

Average consumer claim value

For consumers who stated a monetary value to resolve their dispute, the average stood at £12,615 for the past three months – the second highest quarterly figure seen in 2023.

To view and download the infographic below as a PDF, please click here.

To view and download The Motor Ombudsman’s thought leadership paper on electric vehicle disputes as a PDF, please click here.